What happens when Ethereum will switch to Proof of Stake (PoS)?

Source:

Source:What happens with Ethereum (ETH), when the acne Buterin will transfer the platform to the new Protocol? Can I create Ethereum after the transition to PoS? What are the theoretical pros and cons of the transition? In this paper, we analyze the specific details of some promising and innovative PoS systems that have tried to create, as well as the last sentence Ethereum aimed at solving many network problems, such as excessive absorption of energy by the algorithm PoW (Proof of Work) and the availability of ASIC miners Ethereum.

theWhat will happen to the Air after moving to Casper?

Before delving into the features of Proof of Stake ("the proof of share ownership", or just PoS), it is important to clarify why anyone would use such a system consensus. In fact, the PoS allows you to create a data structure with the following properties:

the- Database will be able to develop ("Liveliness", in the terminology of Casper); the

- Participants will be able to agree on the contents of the data because the node (nodes) will be the mechanism of choice between the conflicting chains confirm ("Security", in the terminology of Casper).

No One controls the content data (a distributed storage and validation of data is not enough); the

Consensus PoW, Proof of Work ("proof of work"), uses the most precise rule for choosing between competing chains confirm (fork choice rule, the "rule of choice" branch). It is not only obvious solution for the above three criteria — the PoW mechanism in itself also solves the problem of the production unit and the time of its creation. Despite the fact that accumulated work determines the choice of the chain, the manufacturer of the unit must also include the PoW element in each block (a stochastic process), and therefore the question of who produces each unit is made and when each block is solved in PoW.

PoS is a General concept of the choice of the branching of the chain based on the accumulated share of ownership (that is, chains for which voted more coins which bet the overwhelming number of them). But unlike PoW, this algorithm will not necessarily solve the issue of who produces each unit or when these blocks are produced. These problems will have to solve other mechanisms. PoW solves the problem of distribution of the coins, and to the system based on the PoS for this, probably also need to add more solution.

theWhat is PoS? The Byzantine generals problem

The Byzantine generals Problem illustrates some of the main problems associated with the attempt to create a data structure with the aforementioned properties. In fact, it is the problem of choice of time and determine what changes in the registry occurred first. However, if a third or more of the actors will rebel, the problem will be intractable from a mathematical point of view, as Leslie Lemport proved in 1982.

"it is Proved that using only oral messages, to reach an agreement only if two thirds of the generals are loyal; so a single traitor can confuse two loyal generals."

PoW, therefore, can be regarded as a flawed Protocol that will be strong Byzantine fault-tolerant system, but definitely not reliable mathematically. In this context, speaking of non-ideal systems, PoS alternatives, such as PoW will also have its drawbacks.

In PoS there are two competing schools of thought. One of them came out of the PoW. Coins based on it include Peercoin, Blackcoin and the first iteration of proposals from PoS Ethereum. The second school of thought largely based on academic research of Lemport 1980-ies and welcomed the conclusion to which he came Lemport: to create a fault-tolerant Byzantine system you need a majority of two thirds. The current iteration of the proposal from Casper Ethereum takes just did the second option.

thethe benefits of Proof of Stake

PoS is usually considered in the context of the PoW as an alternative, which solves or alleviates a number of negative consequences of the problems inherent in systems based on PoW:

theMore eco-friendly system

Perhaps the most powerful advantage of a PoS system is the absence of energy-intensive process that supports PoW. If the PoS system will be able to achieve the same valuable features as the PoW system, the environmental damage can be attributed. This is an important positive point for PoS, although the problem is probably exaggerated: to maintain the same Bitcoin often find that they are often renewable or even take away the excess energy, which is still impossible to properly store, don't have methods.

theStrong alignment of incentives

Another problem with PoW is that the interests of the miners may differ from the interests of the holders of the coins, as miners can survive on short-term return on investment and sell your coins as fast as possible, without thinking about the price increase. Another problem is that hash rate you can rent, and the tenant will have no economic interest in the long-term prospects of the system. PoS is directly connected agents, a consensus with the investment in a coin, theoretically aligning the interests between investors and parties to the agreement.

thethe Centralization of mining, and ASIC

Another benefit of PoS systems is that they can improve decentralization. PoW mining includes a number of centralized forces, which are impossible in PoS:

the-

the

- Production of ASIC miners are expensive and centralized (Bitmain has a huge market share). the

- Production of expensive and centralized chip (TSMC, Intel, Samsung, SMIC, they cannot compete). the

- Associated with ASIC technology can be patented. the

- source of cheap energy may not be so much.

Many aspects of mining are a scalable economy, for example, the cost of maintenance and electricity costs, leading to centralization.

General economic weakness Proof of Stake

Incomplete solution

As we have seen, systems PoW can kill four birds with one stone:

the-

the

- Choose the chain (choice branches); the

- the Distribution of coins; the

- Who makes the block, and the

- is a block.

PoS, on the other hand, can be a decision only to select a chain, leaving other problems unresolved.

theis“Unfair” economic model

One of the frequent topics of criticism of PoS systems is that they distribute new funds in proportion to existing savings. Consequently, "money make money", the rich get richer and all of this translates into the fact that a few rich users have greater riches than it would be in an egalitarian system PoW. If someone invests in the PoS system at the start, he will be able to maintain their share of the wealth, and PoW-your wealth is eroded, because the new rewards go to miners. When handing out rewards in proportion to existing savings, you can assume that it is not inflation, but the reward will be economically equivalent to adding zeros to the currency. Consequently, the reward system will be meaningless and will not create any incentives. However, this will be true only if all users will be PoS-validators, whereas in reality some will want to use the funds for other purposes.

theRisk of loss

Another problem is that stacking (that is, in fact, the possession of shares) requires the signature of the message using the systems connected to the Internet. Consequently, stacking will require storage in a “hot wallet” that increases the risk of theft of funds forces hackers. However, this can be mitigated if the “show” private key share for a short time and return the entire balance back to the owner. However, hackers can bypass this mitigation. Another possible mitigation strategy might be to create special equipment for staking.

theTechnical weaknesses PoS

"Nothing at stake"

The basis of the consensus problem is the timing and order of transactions. If two blocks are born at the same time, PoW solves this problem through a random process, allowing the units to compete among themselves. What will build the longest chain is the winner. PoW requires energy in the real world is very limited, so the miners have to decide what chain to use this resource.

In the PoS system, this process, in contrast, is not clearly clarified. If two blocks are produced simultaneously, each conflicting block can form a proportion. In the end, one unit will have a greater share than another, will be the winner. The problem is that if the owners of a share can change your selection and return to the winner because the system is assembled on one circuit, why not use its share in the many chains?

In the end, share is a resource inherent in the circuit and is not connected with the real world, so the same proportion or rate can be used on two conflicting chains. Is born the problem of "nothing at stake", which is considered one of the most serious for Proof of Stake.

thethe Problem of "nothing at stake" (Nothing at Stake)

The Problem of "nothing at stake" adds to the community system, since the same rate can be applied to multiple competing chains, creating a risk of increase in rewards for owners. In contrast, in a PoW-systems, energy is a finite resource of the real world, and "the same" operation cannot be applied to a variety of competing chains.

Protection #1

The Problem can be avoided or mitigated. Protocol can be configured so that if a shareholder put it on a few circuits, the third party may provide evidence that each of the circuits, which will lead to punishment-the confiscation. Alternatively, instead of punishment, the fraudster can lose...

Recommended

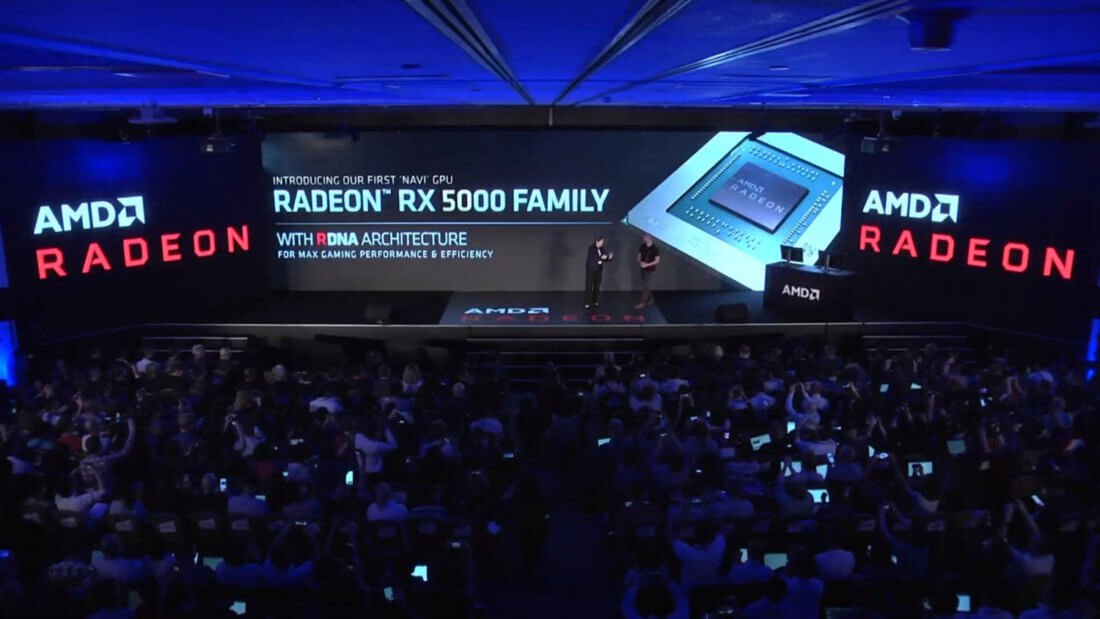

the long-awaited summer. Niche cryptocurrency supported the event and gave unusually hot week. During the last seven days, we learned about the new line of graphics cards from AMD, the mining in TON and hard forks . In addition dealt with the profita...

Co-owner Bitcoin.org Coinbase Pro ridiculed and called a stock exchange Scam

co-Owner Bitcoin.org and most popular forum about cryptocurrency Bitcointalk.org Cobra called Coinbase Scam Pro trading platform American crypto currency exchange Coinbase. In his tweet he wrote «if you read Coinbase Pro backwards, get the word ...

The Ethereum is a cryptocurrency Scam. A new report Chainalysis

When people learned how to create a new cryptocurrency and began to build their infrastructure like marketplaces, in the field began to appear and fraud. According to blockchain auditor Chainalysis for the past two years, fraud in the ecosystem has s...

Related News

The Chilean stock exchange has filed a lawsuit against the local banks for "murder of cryptocracy"

Two weeks ago, a Chilean Bank Banco Estado accounts of three of the country's largest cryptocurrency exchanges: BUDA, Crypto MKT, Orionx. The reasons for this decision in a financial institution is not called. The owners of the ex...

Boris Schlossberg: the gold was taken from the title of the Bitcoin safe asset

In the first half of March, the staff of the Knight Frank report, entitled the Wealth Report 2018. According to them, over the past year, interest in the cryptocurrency as an investment instrument has increased by 16 percent, wher...

Chinese Bitmain received a license for mining in USA

last week, Chinese device maker for mining Bitmain about the opening of a subsidiary in Switzerland. For tighter regulation of the industry in China, the firm intends to transfer all your power to the North of Europe. However, thi...

Let there be growth: experts predict a rise in price of Bitcoin this week

For the past seven days Bitcoin has managed to rise and gain a foothold at a higher level. Except for a small 100 dollar subsidence, Friday course the coins do not fall below $ 8000. This is a good sign. Because of the current sit...

Where to store bitcoin: preparing for a subcutaneous microchip-purses

the Dutchman Martin Wismeijer very careful in choosing where you store your bitcoins — so careful that in 2014 he introduced his two NFC chip in each hand to keep your encrypted Bitcoin keys. Wismayer cited several reasons for suc...

The network of Bitcoin it took 70 forks. Only 10 of them were commercially successful

In January on the basis of ZClassic fork, which appeared coin Bitcoin Private (BTCP). Three months later, the koina rate increased by 104 per cent. However, this success is not all ppl were — according to the service , since the l...

The authorities of Louisiana will hold ISO for the replenishment of the local budget

For the first two months of 2018. ICO-projects worldwide more than 3 billion dollars. Given the two rounds of initial placement of the token Telegram, by the beginning of March the amount is at least $ 4.7 billion — almost as much...

The Central Bank of Lithuania: prohibition of cryptocurrency to nothing lead

In March, the Central Bank of Lithuania of intention before year-end to issue its own cryptocurrency. The Agency soon determined the denomination, quantities and methods of distributing the national collection of coins that will a...

CRYPTOMACH / Secret mining farm in an abandoned factory, mining Callisto and earnings on masternode

Today, the end of the week. As always, it is the results of summing Cryptoimage. The last seven days remember tons of analysts at the exchange rate of Bitcoin, the actions of the Ministry of internal Affairs in the Orenburg region...

Nobel prize winner Robert Shiller: Bitcoin a bubble that will burst soon

In January, the Nobel laureate in Economics and author of a book on financial bubbles, Irrational exuberance Robert J. Shiller the Bitcoin. According to him, the coin expects a disaster, but growth rates reminiscent of the "Tulip...

Why Bitcoin has a chance to rise to 250 million by 2022. Five arguments

Yesterday, investor Tim Draper 250 thousand dollars for one bitcoin four years later. The owner agrees that assumption seems crazy, but it will happen. The coin really is, the chances of such a jump. Present five arguments in favo...

Pantera Capital, Bitcoin is likely to overcome 20 thousand dollars this year

on Friday, the experts growth prospects of Bitcoin. In their view, the uptrend will have to wait one month, because the drop rate got burned too many investors. Representatives of the hedge Fund Pantera Capital do not agree with t...

Japanese exchange GMO leases bitcoin users

Japanese exchange GMO informed of intent to sell charges for mining through ICO. Now the company has decided to launch bitcoin deposits with a yield of 5 percent per annum. About it Bitcoin.com. the How to make money on bitcoin ...

Japan has suspended the work of two cryptocurrency exchanges

In late January, hackers broke into the Japanese exchange Coincheck. Her purse was stolen 500 million tokens NEM, which then cost 435 million dollars. After this, the Japanese authorities have conducted an extensive investigation ...

Tim Draper promises 250 thousand dollars for one bitcoin by 2022

In the second half of March Whether Bitcoin exchange rate at level 91 thousands of dollars by early spring of 2020. To obtain the exact number of entrepreneur helped calculations and careful analysis of the behavior of coins. Inve...

The Muscovite has lost 20 thousand dollars while trying to sell cryptocurrency

Yesterday in Singapore, the buyer of bitcoins. Pang Jun How specially came for the coins of Malaysia, but in the end lost money. Fortunately, the fraud was detained the next day, and part of the funds already spent on new Rolex wa...

Latvia will impose cryptocurrency transaction tax of 20 percent

In February, the Ministry of Finance the amendments on the taxation of cryptocurrencies and mining. According to the documents, the sale of coins will be subject to personal income tax at the rate of 13 percent and the miners wil...

Mastercard will expand its expertise in the blockchain

last year, Mastercard CEO Ajay Banga cryptocurrency garbage because they are issued not by the Central banks of States. The company is prepared to use the blockchain and already introduced the technology to the payment network fo...

In Singapore robbed capturadora. He tried to buy with cash

In March a group of unidentified persons 20 thousand dollars from the developer of the cryptocurrency PRIZM Yuri Mayorov. The company representative then stated that the attackers were going to not only steal money, but also to se...

In Krasnoyarsk region want to create a mining-farm for 3 billion rubles

on Wednesday, interior Ministry officials mining farm in the Orenburg region. According to law enforcement, found of more than 6,000 ASIC miners, the cost of which amounted to about 9.3 million dollars. The reason for the detentio...

Comments (0)

This article has no comment, be the first!